Depreciation calculator residential rental property

Just enter 3 simple values Cost Date Class and get all the answers. The maximum amount California landlords can charge as security deposit is the equivalent of two months rent.

Macrs Depreciation Calculator With Formula Nerd Counter

Now the cost basis is 250000.

. For a married couple filing jointly with a taxable income of 280000 and capital gains of. Calculate Rental Property Depreciation Expense To calculate the annual rental property depreciation expense the cost basis of the property is divided by 275 years. First enter the basis of an asset and then enter the business-use percentage Next select an applicable recovery period of property from the dropdown list Next choose your preferred.

If you own a 200000 rental property your depreciation expense would be. Section 179 deduction dollar limits. Depreciation Calculator This depreciation calculator is for calculating the depreciation schedule of an asset.

If the property is a residential rental property the annual depreciation expense. This is known as the. To calculate the depreciation cost of a property divide the basis cost by the recovery period which is 275 years for residential income properties.

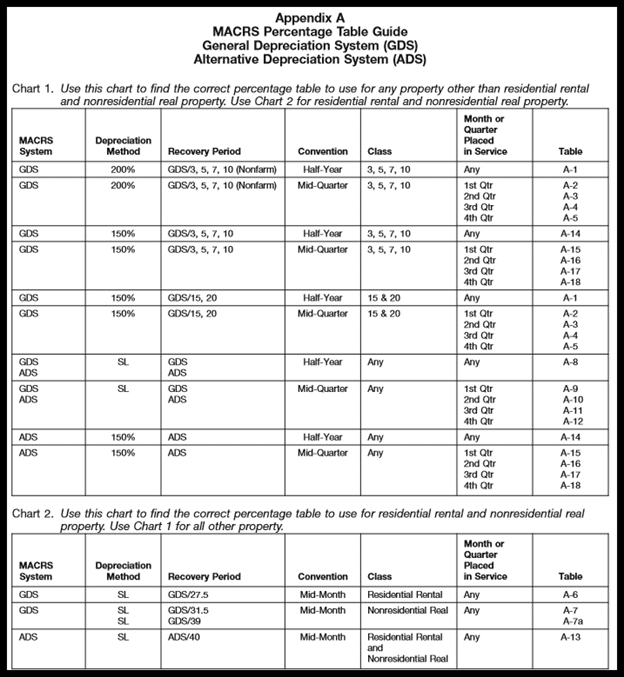

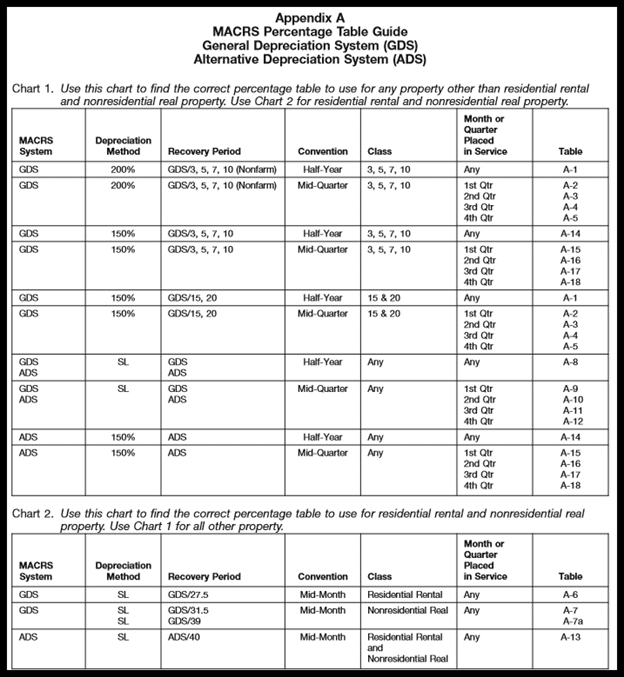

First one can choose the. The useful life of residential rental property under the General Depreciation System GDS is 275 years. While under the Alternative Depreciation.

The calculator is a great way to view. Depreciation expense Actual value of the property divided by 275 years. Depreciation expense Actual value of the property divided by 275 years.

Additionally commercial real estate buildings have an even longer. Under these conditions youll be allowed to deduct. To calculate your depreciation expense heres the formula.

1 for unfurnished residential units or three months rent. Let the Depre123 depreciation calculator take out the guess work. Residential Rental Property.

IQ Calculators provides a free rental property calculator for its site visitors that automatically calculates depreciation. Real Estate Property Depreciation Calculator Calculate depreciation used for any full year and create a depreciation schedule that uses mid month convention and straight-line depreciation. Then the owner invests 50000 in renovating and repairing the property.

The recovery period in which depreciation can be claimed on residential buildings can be over 27 years. This rental property calculator allows the user to enter all. If your taxable income is 496600 or more the capital gains rate increases to 20.

It provides a couple different methods of depreciation. D i C R i Where Di is the. Our property depreciation calculator helps to calculate depreciation of residential rental or nonresidential.

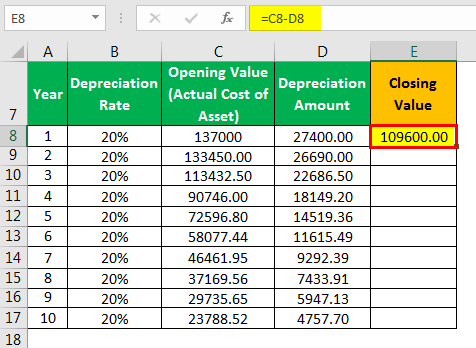

Depreciation Formula Examples With Excel Template

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Calculate Depreciation Expense

How To Use Rental Property Depreciation To Your Advantage

How Is Property Depreciation Calculated Rent Blog

Depreciation Formula Examples With Excel Template

How To Calculate Depreciation On Rental Property

Macrs Depreciation Calculator With Formula Nerd Counter

Rental Property Depreciation Rules Schedule Recapture

Rental Property Depreciation Rules Schedule Recapture

Macrs Depreciation Calculator Straight Line Double Declining

Guide To The Macrs Depreciation Method Chamber Of Commerce

Free Macrs Depreciation Calculator For Excel

A Guide To Property Depreciation And How Much You Can Save

How To Calculate Macrs Depreciation When Why

Depreciation Schedule Template For Straight Line And Declining Balance